Weekly Forex Forecast - 15/12: (Charts)

Fundamental Analysis & Market Sentiment

I wrote on 8th December that the best trade opportunities for the week were likely to be:

The weekly gain of 1.91% equals 0.38% per asset.

Last week’s key takeaways were:

- US CPI (inflation) – the annualized rate rose from 2.6% to 2.7% as expected.

- US PPI – this was higher than expected, rising on a 0.2% increase the previous month to 0.4% this month, suggesting inflationary pressures remain. Both these top two items helped to strengthen the US Dollar.

- European Central Bank Main Refinancing Rate & Monetary Policy Statement – a rate cut of 0.25% was given as expected. The Bank also took a minor dovish tilt on the inflation outlook which helped to weaken the Euro.

- Reserve Bank of Australia Cash Rate & Rate Statement – the Bank held its Cash Rate steady at 4.35% as expected, but the Bank took a minor dovish tilt by suggesting cuts were on their way in 2025, which helped to weaken the Aussie, although it remains stronger than the New Zealand Dollar with which it is usually strongly correlated.

- Bank of Canada Overnight Rate & Rate Statement – a rate cut of 0.50% was implemented as expected, which helped send the Canadian Dollar lower to a 4-year low against the US Dollar.

- Swiss National Bank Policy Rate & Monetary Policy Assessment – a rate cut of 0.25% was implemented as expected.

- UK GDP – showed a contraction of 0.1% for the second consecutive month, raising fears of a recession in the UK which would surely require serious rate cuts.

- US Unemployment Claims – this came in slightly higher than expected.

- Australian Unemployment Rate – this was notably better than expected, falling to 3.9% when 4.2% was expected.

Another noteworthy item are remarks coming from a Bank of Japan official in suggesting that the Bank may pass on a rate hike at its next policy meeting. This could cause considerable weakness in the Japanese Yen.

Last week basically saw a continuation of the ongoing trend theme of a strong US Dollar and stock market, with the tech-based NASDAQ 100 Index rising to reach a new all-time high. It is not a simple “risk on” scenario, the boom is especially centered on US assets.

Last week also saw rate cuts from three major central banks, despite the stickiness of US inflation. Also, the US inflation data came in as expected, and the data triggered a firm rise in US stock markets.

The Week Ahead: 16th – 20th December

The coming week has a big schedule with some of the biggest items in the Forex market: a US Fed policy meeting expected to bring a rate cut, and two other central bank policy meetings, although neither is expected to produce a rate cut. This means it will likely be another important week, as it is effectively the last trading week before Christmas when many people will be away from the markets for two weeks or so.

The coming week’s important data points are:

- US Federal Funds Rate, FOMC Statement & Economic Projections – a rate cut of 0.25% is expected by almost everyone.

- US Core PCE Price Index – this is the Fed’s preferred inflation indicator, so it can be impactful.

- US Final GDP – annualized economic growth is expected to remain steady at 2.8%^.

- Bank of Japan Policy Rate and Monetary Policy Statement – no rate hike is expected.

- Bank of England Official Bank Rate, Votes, and Monetary Policy Summary

- US, German, British, French Flash Services & Manufacturing PMI.

- US Retail Sales

- UK CPI (inflation)

- Canadian CPI (inflation)

- UK Retail Sales

- Canadian Retail Sales

- New Zealand GDP

- US Unemployment Claims

- UK Unemployment Claims (Claimant Count Change)

Monthly Forecast December 2024

For the month of December, I forecasted that the EUR/USD currency pair would fall in value. The performance of my forecast so far is:

Weekly Forecast 15th December 2024

Last week, I made no weekly forecast as there were no unusually strong price movements in currency crosses, which is the basis of my trading strategy.

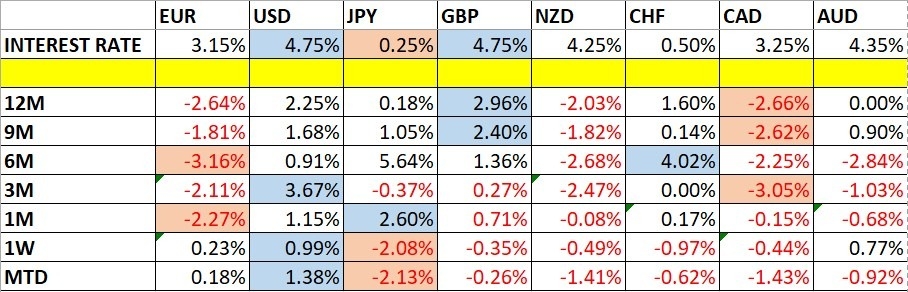

The US Dollar was again the strongest major currency, while the Japanese Yen was the weakest. Volatility fell slightly last week, with only 41% of the most important Forex currency pairs and crosses changing in value by more than 1%.

You can trade these forecasts in a real or demo Forex brokerage account.

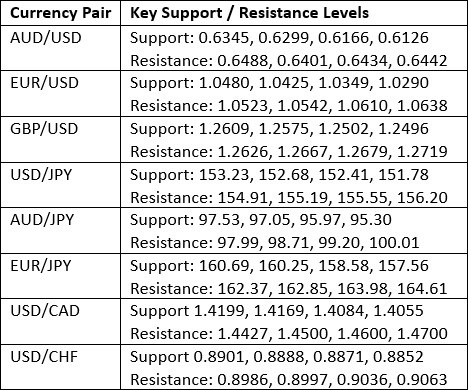

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

Last week, the US Dollar Index printed a bullish candlestick that continued in the direction of the long-term bullish trend. The recent price action also seems to have retested the upper trend line of the formerly dominant consolidating triangle chart pattern, which can be seen in the price chart below. The price is above its price from three and six months ago, suggesting a healthy long-term bullish trend in the greenback that should be exploitable.

I have plenty of fundamental reasons to be bullish on the US Dollar. However, the upside over the coming week might be limited, so long-term trades long of the USD might be more successful than short-term trades. However, the price action is definitely more bullish than it was last week, and I think we will see another week of gains by the greenback this week.

We will be getting highly important US Core PCE Price Index data and FOMC data on the US economy this week, so technical factors might not be very important, with price action over the second half of this week likely to be more data driven.

Bitcoin

Bitcoin has continued to chop around the $100,000 level over the past week, printing a bullish inside candlestick which failed to make a new record high. Although it can be argued that there are signs that the momentum has stalled or slowed, the price action remains bullish and a breakout over the coming week looks more likely than a significant bearish breakdown to happen.

The strong long-term bullish trend is something worth paying attention to, and it has been given a tailwind by the Republican victory in the recent US elections. The price chart below shows a spectacular long-term bullish trend which has been ongoing for the past two years.

To exploit the bullish breakout which I expect to happen in the safest way possible, I would wait for a new record daily high closing price before entering a new long trade, above $103,647.

EUR/USD

The EUR/USD currency pair is in a valid long-term bearish trend. This currency pair typically takes its time to move, with its trends usually including plenty of deep retracements, but for almost three weeks after plunging to a new long-term low price well below $1.0400, the price consolidated without turning definitively bearish.

The Dollar is relatively strong, while the Euro has been weakened a bit lately by the more dovish approach the European Central Bank took at its policy meeting last week.

This currency pair often has very reliable trends, which is why I am interested in being short, but the price action off the lows over recent weeks has been too bullish for my liking, and we are still some way off the lowest daily close at $1.0414. So, I would wait for a New York close above that price before entering a new short trade here.

NZD/USD

Last week, the NZD/USD currency pair printed a large, strongly bearish candlestick, closing right on its low. It closed at a 2-year low, which is a significant bearish breakdown in any asset.

The Australian Dollar has got a lot of attention lately as it weakened to new long-term lows as the RBA passed on a rate cut, but it is worth noting that the New Zealand Dollar is also very weak, but even more so, making the Kiwi attractive on the short side.

The Kiwi was weakened by last week’s 0.50% strong rate cut by the Reserve Bank of New Zealand, although it was widely expected.

This currency pair does not trend very reliably, so I don’t take long-term trades in it, but it certainly looks very weak right now.

USD/CAD

Last week, the USD/CAD currency pair printed a bullish candlestick, closing not far from its high although it had some upper wick. It closed at a 4-year high, which is a significant bullish breakdown in any asset. The price action is bullish, no question about that.

The Loonie was weakened by last week’s 0.50% strong rate cut by the Reserve Bank of New Zealand, although this was widely expected.

This currency pair does not trend very reliably, so I don’t take long-term trades in it, but it certainly looks very strong right now.

The main commodity currencies (CAD, NZD, AUD) are all weak, so it might be that they are best traded as a short basket over the coming week against a stronger currency.

NASDAQ 100 Index

Last week saw the NASDAQ 100 Index print another bullish candlestick to reach and close at a new record high for the second week running. The price closed not far from its high, although the candlestick was small and slightly doji-like, which suggests the trend may be running out of steam. More evidence in that direction is shown by narrowing of the linear regression analysis within the price chart below. However, when the price of a major stock market index is trading in blue sky, that is a bullish sign that must be paid attention to.

US stock markets are leading global equities, which is nothing unusual, boosted by President Trump’s reputation as doing anything to generate economic growth and stock market growth, as well as his recent announcement of his intention to put strong tariffs on imports from Mexico and China.

Maybe more importantly, the US stock market has been in a strong bullish trend for over one year now, so there is plenty of momentum supporting last week’s bullish move.

I see the NASDAQ 100 Index as a buy.

Cocoa Futures

Cocoa futures have been rising powerfully over the past five weeks, especially over the past week which printed a very large, strong, bullish candlestick.

Trading commodities long when they break to new 6-month high prices, especially when there is powerful momentum as there is here, has historically been a very profitable trading strategy, so there are plenty of good reasons to be long here.

During the second half of 2023 and the early months of 2024, the price increased by almost 600%, which is a meteoric rise. This happening so recently suggests that it could happen again, giving even more reason to be long here.

Cocoa is a superfood and is becoming better known for its health-giving properties when used in moderation. This is another factor which is giving the price a tailwind.

I see Cocoa as a buy, but I point out that Cocoa futures are very big, worth approximately $100,000 which is a dangerously large position size for most retail traders. Trading Cocoa CFDs can be dangerous over the long term as overnight swaps will usually be very high. Therefore, I urge retail traders to look into Cocoa ETFs or ETCs such as COCO which own cocoa futures but can be purchased for only a few US Dollars per share.

Bottom Line

I see the best trading opportunities this week as

- Long Bitcoin in USD terms following a daily (New York) close above $103,647.

- Short of the EUR/USD currency pair following a daily (New York) close below $1.0414.

- Long of the NASDAQ 100 Index.

- Long of Cocoa futures or a Cocoa ETF/ETC.

Ready to trade our weekly Forex forecast? Check out our list of the top best Forex brokers.