HR Futures: Rangebound and waiting for 2025

David Feldstein is the President of Rock Trading Advisors. Rock Trading Advisors is a National Futures Association Member Commodity Trade Advisory providing commercial clients with price risk solutions in ferrous, energy, and interest rate derivatives markets.

In the last article written for SMU, we looked at the rallies that followed both the 2016 and 2022 presidential elections, as well as the moves in the NFIB Small Business Optimism Index. The question was, “Will Trump’s election and lower interest rates boost small business optimism in the months ahead?” The answer was clear when the NFIB released its November reading, jumping eight points to 101.7, its highest since June 2021.

NFIB Small Business Optimism Index

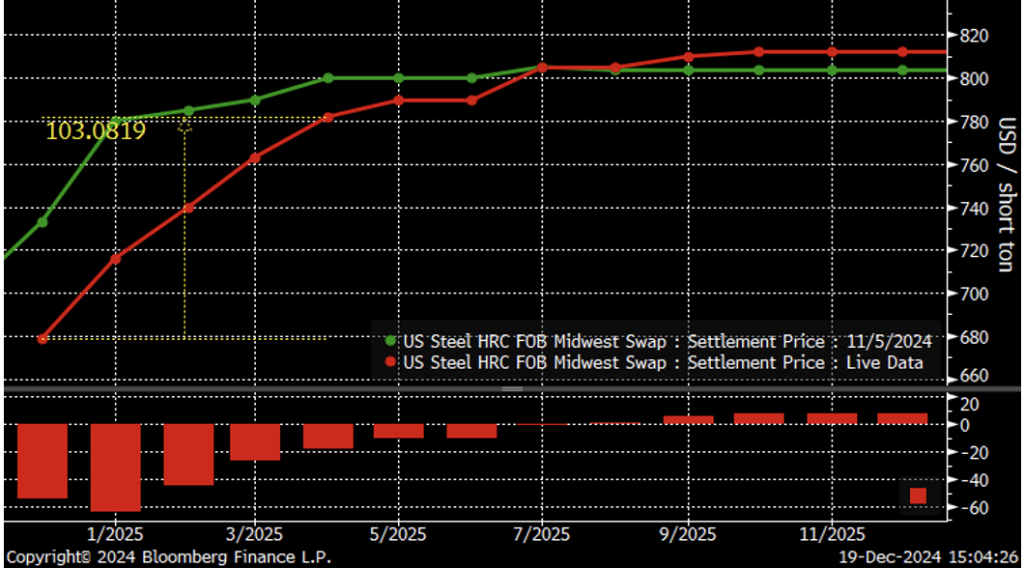

However, not only was there no rally in Midwest HRC futures as there was in 2016 and 2020, but instead the futures have been under pressure, falling $40 to $60 since Election Day in the months of December, January, and February. The latter months have seen little change, with the curve’s contango steepening further since Nov. 5. The curve has had a recovery priced in for many months, but nothing has provided the futures with the kind of optimism seen in the NFIB Small Business Optimism Index above. Not the election of Donald Trump. Not Trump’s threat to levy a 25% tariff on imports from Canada and Mexico. Not Cleveland-Cliffs idling the C-6 blast furnace at its Cleveland Works in Ohio or last week’s $800 price increase announcement.

CME hot-rolled coil futures curve $/st

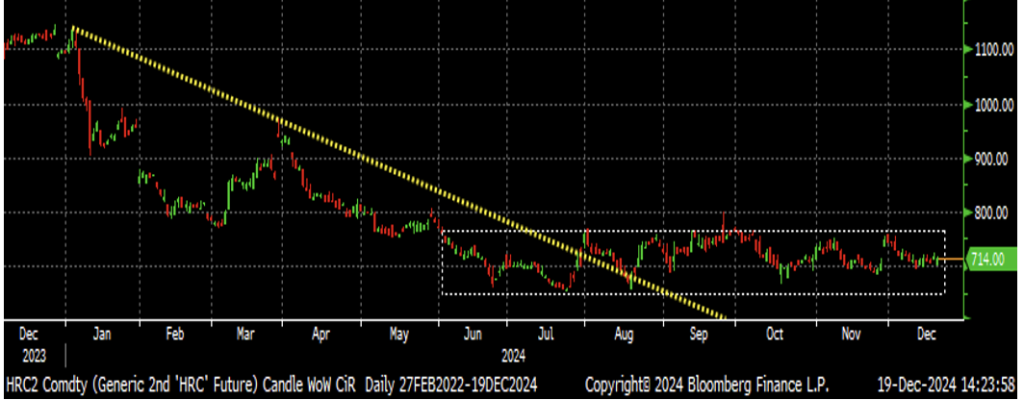

While the HRC futures fail to launch, they aren’t exactly diving, either. In fact, the rolling 2nd month Midwest HRC future has been stuck in a range between roughly $650 and $775 for seven straight months.

Rolling 2nd month CME Midwest HRC future $/st

Midwest HRC is a lot of things, but stable and rangebound is not one of them. This market is almost always trending one way or another, and with gusto! However, there was one year, 2017, when HR sat in a range between $560 and $650 throughout the entire year. That year, 2017, has some interesting similarities to the present, not only with respect to Donald Trump, but also a tremendous amount of uncertainty related to his trade policy. In 2017, it was the Section 232 tariffs that Trump threatened to impose. Yet, the futures market sat in a range.

Rolling 2nd month CME HRC future $/st 2017

That is until it wasn’t. Then it went on a monster rally, at least for that period, taking HR up through $650, above $700, and then above $800, and then above $900!

Rolling 2nd month CME HRC future $/st 2017-2018

There was a massive restocking in the back third of 2023 that took futures up $450 over four months. Despite a very quiet, and what seemed to be weak, December of last year, the futures held their ground, trading above $1,100. The rolling 2nd month future ended 2023 at $1,093. When trading reopened in 2024, it rallied for two days, settling at $1,135 on Jan. 3.

Rolling 2nd Month CME HRC Future $/st

Over the next five trading sessions, it rapidly adjusted, falling $216 to $919. It was somewhat puzzling as to why the futures did not fall last December, but instead waited to tank in the first weeks of the new year.

The most obvious explanation is it is the fault of the financial traders. You see, most financial traders and banks’ trade desks get very conservative in December. There is a saying that goes something like, “If you are still trading in December, then you did not have a good year.” Thus, most traders shut down their books and start heading for the doors to enjoy a little R&R in the final weeks of the year. Without the traders to poke and prod with their price discovery algorithms and high frequencies, the market is stuck in an equilibrium limbo until they return. When the new year starts and the gun goes off, the P&L starts anew for this group, and then we are off to the races once again.

With the HRC futures curve indicating prices are heading back up to $800 in 2025, will we see a sharp rally right out of the gates following New Year’s Day? Like 2024 in reverse? Or will we see the cash-and-carry hedgers come in to smash the futures curve down in the months of March forward, taking out the premium built into the contango?

Here is another puzzler. Volatility is a measure of by how much a financial security fluctuates. When you see the S&P 500 was up 2.2% in a day, that is a measure of that day’s volatility. Volatility is then standardized by putting it into annualized terms. For instance, a financial product’s daily fluctuations over a certain period of time, let’s say 60 days, are taken, and with some math is turned into an annualized volatility measure for said product. A time series of 60-day volatility can be created as shown in white in the graph below. This is the “historical” 60-day volatility for the February CME Midwest HRC future. You can see that volatility spiked from 17% to 30% in March 2023 when the futures market spiked. Then it calmed back down into the 15-20% range where it has been since June 2023. As indicated above, HRC futures have been stuck in a range for seven months. Thus, volatility has been muted.

Historical (white) and implied (blue) volatility – February CME HRC future $/st

The turquoise line is what is called “implied volatility.” Implied volatility is where the options for the underlying future are trading or settling as if there is no trading. Firms that sell options, or as they call it selling volatility, hedge the underlying derivative or future. I could spend a few pages explaining what that means, but instead I am going to say that they simply isolate the volatility as if it was a price.

If you sell a steel future at $800 and buy it back at $700, you make $100 profit. In the same way, a volatility trader that sells volatility at 30% captures a gain or a loss relative to the empirical or actual volatility that occurs between the time that trader sells the option and the option expires. As you can see from the wide gap between the blue and white line, selling volatility has been a very profitable trade throughout this rangebound year.

You might be thinking, but what about the puzzle foreshadowed above? Here it is. Historical volatility fell to as low as 13% in June and has since rebounded back to the low 20s, having flattened out since September. Implied volatility fell, too, and then also rebounded. Yet, implied volatility has kept on moving higher from 24% to 27% to above 30%, even though actual volatility stopped. The puzzle is why is implied volatility so high? Why hasn’t a savvy option trader entered the market and sold all the volatility they can to take advantage of what looks like an attractive profit?

The same could be said for the futures curve. Why hasn’t a savvy service center or other physical player come in to hedge their $650 physical hot rolled, and sold it forward in Q2, locking in an abnormal profit of roughly $150? Why hasn’t the steep contango in the futures curve been smashed down to secure these profits?

If we were to ask Hans and Franz from “Saturday Night Live,” why this is happening, they would tell us that it is because the option traders and the service centers “are a bunch of girly men,” but I am not so sure. If you were to ask Arnold Schwarzenegger, he would probably say “Hear me now and believe me later.” It would seem that both the option traders and the service centers and the futures market are expecting a big rally is coming. Nobody knows for sure what next year will bring, but we can all agree it is about time to shake off 2024 and “GET PUMPED UP” for 2025!!