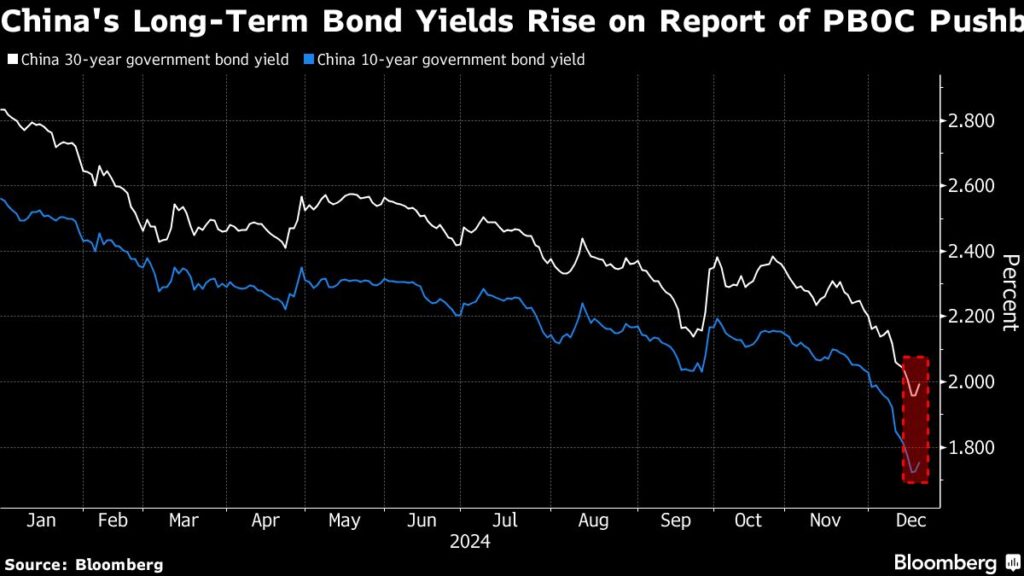

China Pushes Back Against Bond Frenzy, Sends Yields Climbing

(Bloomberg) — China’s central bank sent its first signal in months of its discomfort with the record-setting sovereign bond rally, triggering a slide in the market.

Most Read from Bloomberg

The People’s Bank of China has urged financial institutions involved in “aggressive trading” in the bond market to pay close attention to relevant risks including those in the rates market, PBOC-backed Financial News reported on Wednesday, citing unidentified people.

Yields on the benchmark 10-year bond rose as much as four basis points to 1.77% before trimming the rise to one basis point. That’s after yields fell to a record low earlier in the week. Futures contracts on 30-year bonds declined as much as 1.8%, the most since September, before paring the loss to 0.6%.

Traders had been piling into Chinese government bonds on bets rising risk of a trade war with the US will prompt top leaders to roll out bolder monetary stimulus to support the economy next year. Plunging Chinese yields stoked concern that the nation is heading into a Japanese-style balance sheet recession. The widening China-US yield differential also weighed heavily on the yuan.

“While I think the market will eventually bet on potential 40-50 basis points cut next year, the regulators probably view current move too fast too quick,” said Ju Wang, head of Greater China FX & Rates Strategy at BNP Paribas SA.

The Chinese central bank has sounded verbal warnings earlier this year to slow the buying frenzy in the sovereign bond market. It also conducted regulatory checks with bond investors and sold long-term bonds. However, uneven economic recovery, disappointment over measures to support growth have been a drag on yields.

“After a relentless rally in China bonds, this could be an excuse for the market to take a profit,” said Kiyong Seong, a macro strategist at Societe Generale SA in Hong Kong. “However, the PBOC’s warning may not change the trend.”

Seong expects China’s 10-year yield to rise to 2% in the first quarter of 2025. Other analysts have offered more bullish views earlier. Tianfeng Securities, Zheshang Securities and Standard Chartered Bank predict yields to drop to as low as 1.5%-1.6% by the end of 2025.

Authorities had previously expressed concern of one-way buying in the bond market following the 2023 collapse of Silicon Valley Bank, which piled into US Treasuries before a market reversal. The PBOC might be hoping to prevent excessive long bond positions to avoid risks resembling a Silicon Valley Bank fallout, BNP’s Wang said.