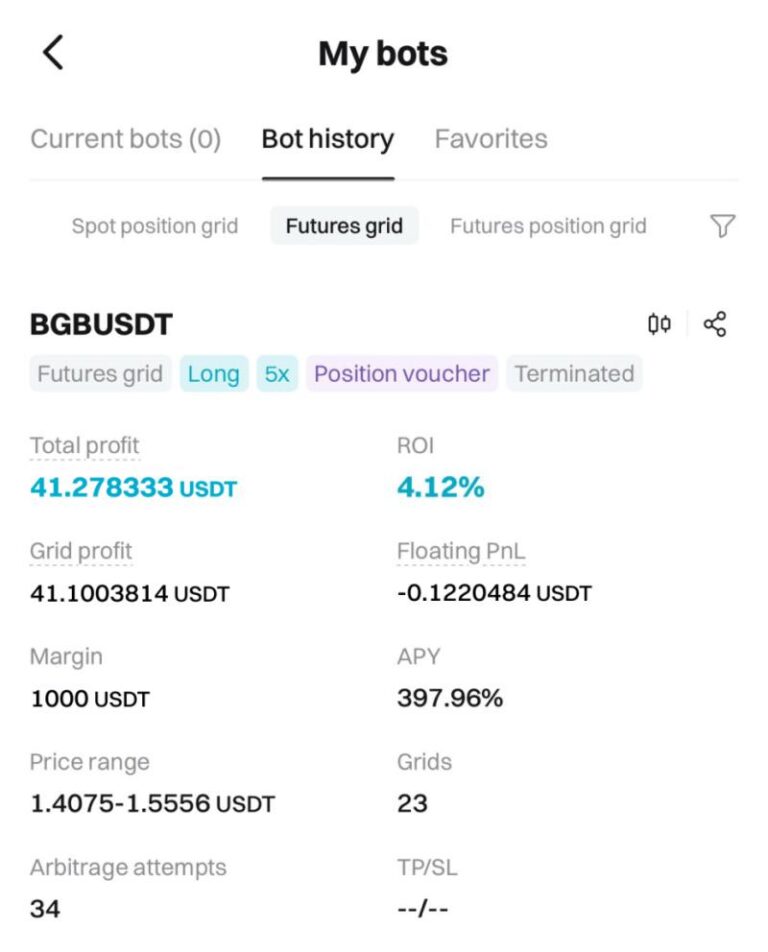

Malaysian Palm Oil Futures End 2024 On A High Despite December Dip

What’s going on here?

Malaysian palm oil futures wrapped up 2024 with a robust 21.37% rise, a strong rebound from previous years’ declines, although they dipped on the last day of trading.

What does this mean?

The benchmark Malaysian palm oil futures bounced back impressively by 21.37% in 2024, overcoming the hurdles of the past two years. Despite a slight decrease on December 31, the futures reflect intricate global market forces. Soyoil prices showed mixed trends: while the Dalian Commodity Exchange saw a rise in its soyoil contracts and a drop in palm oil, Chicago’s soyoil saw modest gains. These fluctuations underscore the intense rivalry among key edible oils. Meanwhile, a slight boost in oil prices was linked to China’s manufacturing growth, but overall demand uncertainties persist. The ringgit’s strength against the US dollar increased the cost of Malaysian palm oil for global buyers, impacting export figures, which are estimated to have fallen in December from November. This scenario depicts a market navigating through competitive pressures and broader economic concerns.

Why should I care?

For markets: Vegetable oils jostle for position.

The shifting balance between soyoil and palm oil prices signals strategic changes in the global edible oils market. With year-end volatility and shifting regional demand, investors should keep a keen eye on these commodities for emerging opportunities.

The bigger picture: Global forces at play.

Larger economic factors, like China’s industrial output and currency trends, influence palm oil futures’ narrative. These aspects affect pricing and profitability and offer insights into the broader health of global trade and markets.