Futures and Notional Overnight Moves

Plus, trading ideas for both Nvidia and QQQ

The table below displays median daily price movements in various futures markets, which are leveraged financial products. That means relatively small amounts of capital can control large market positions. This, of course, can amplify both gains and losses.

For example, the NASDAQ futures (/NQ) show median daily moves of $3,948, which means your account has to withstand swings of that magnitude. For traders seeking lower capital exposure, micro contracts like /MNQ move exactly 1/10th of its larger counterpart (in this case $395) while tracking the same underlying market.

This scaling applies across these products: /ES vs. /MES for S&P 500, /RTY vs. /M2K for Russell 2000. Understanding these daily movements is crucial for selecting products that match both your account size and risk tolerance.

Earnings season starts next week.

Earnings season always begins with the banks.

The Financial ETF is XLF.

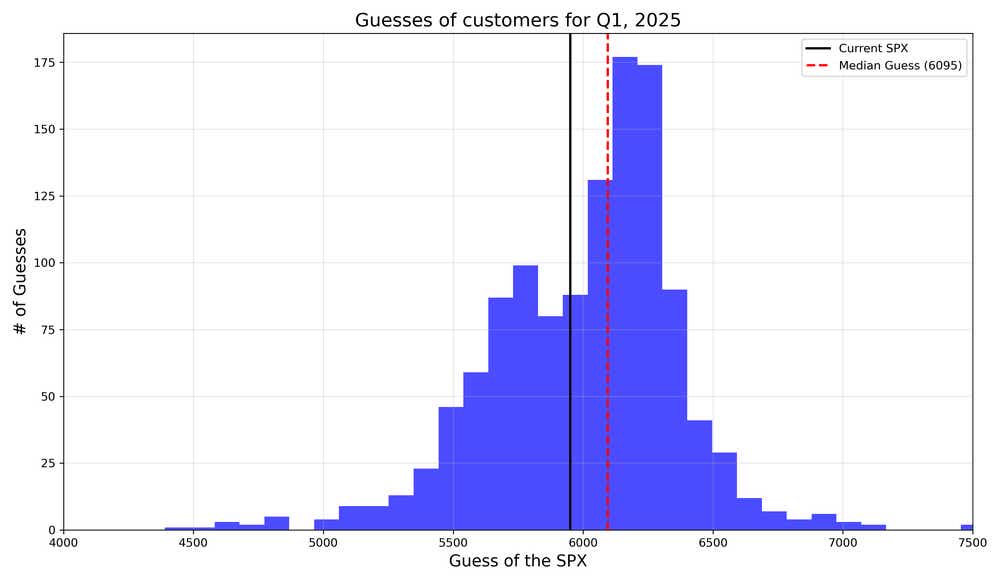

SPX customer forecasts for Q1, 2025

We’ve received several thousands guesses for Q1. The solid black line represents where we are today, and the red dashed line represents the median guess by viewers/customers at 6095 at the end of Q1, 2025.

Yields on the move

The yields have been moving recently. The short end of the curve is declining, whereas the 30- and 10- years have been stable.

Two Trade Ideas: A condor, a butterfly and a crab walk into the trading pits

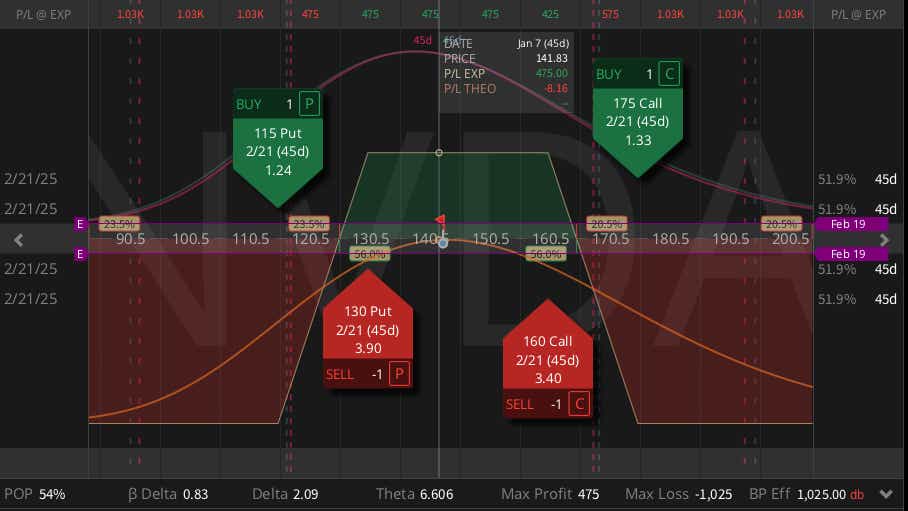

NVDA ($142) iron condor (FEB) $4.77 credit

NVIDIA (NVDA) founder and CEO Jensen Huang’s keynote speech this week at CES 2025 seems to have been a buy the rumor, sell the news event—at least for today! NVDA is back to 140, right in the middle of the range it’s been chopping around since October 2024. If you think it might continue the trend, a good move would be to use an iron condor in February, short the 130/115 put spread and short the 160/175 call spread. This leans slightly long and covers all of the range since October.

QQQ ($517) calendarized ratio/butterfly AKA CRAB (MAR/FEB) $11.87 debit

Looking to get long into this dip but also add some short term theta decay? A CRAB trade is a butterfly/ratio setup, but with the closer ATM option further out in time to add some positive gamma. Go long the 525 call in MAR, with a 2x/1x 550/575 call spread. This has defined risk, long delta, positive gamma, and slightly long theta trade that benefits from an upside grind.

Subscribe to Cherry Picks. Subscribe to Cherry Picks and get our newsletter in your inbox every week.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

![EURUSD Futures (6E Mar 2025): Key Price Levels for Traders Today [Jan 02, 2025]](https://weightedaverage.fun/wp-content/uploads/2025/01/EURUSD-Futures-6E-Mar-2025-Key-Price-Levels-for-Traders.jpg)